Delivering the right origination intelligence to the right people at the right time

The Actionable Intelligence PlatformтДв (AIP) is a highly configurable, mortgage-centric business intelligence solution that enhances sales pipelines and team management, improves operational decisioning, and helps lenders close more loans at a lower cost. AIP delivers meaningful analytics to the right people at the right time to improve customer retention, reduce risk and more.

GET STARTED

Identify pipeline opportunities and optimize organizational efficiency

AIP combines loan origination system data тАФ including data from ICE Encompass┬о LOS or other loan origination systems тАФ with additional big data sources to help lenders retrieve, manage and analyze loan information. Combining the data with powerful business intelligence tools, lenders can easily drill down and proactively identify anomalies and trends, as well as create visualizations to more easily assess the data across the origination operation.

AIP helps lenders:

- Identify growth opportunities

- Reduce pipeline risk

- Reduce cycle times

- Support compliance requirements

- Preserve an audit trail

Powerful mortgage intelligence helps lenders of all sizes support smarter decision-making, generate more leads, reduce risk and lower the cost to originate a loan

AIP delivers pre-configured suites of analytics that are designed to help lenders introduce a number of benefits within their operations.

WhatтАЩs included

AIP supports growth and retention strategies, lead management, retail, wholesale and correspondent channels, loan loss, underwriting, closing and more. Below are some of the suites available in the origination collection:

- Capacity Planning: Provides a focused executive view into┬аoperational activity emphasizing┬аcapacity and priority management.

- Compliance: Incorporates sophisticated business rules that proactively focus on six key areas of origination compliance: HMDA, disclosures, re-locking, change of circumstance, APR and ECOA.

- Correspondent Lending: Provides an enterprise-wide overview of a companyтАЩs correspondent lending activity.

- Early Warning: Delivers analytics focused on properties found in disaster or event areas, with disaster information updated daily.

- Feedback Loop: Helps employees improve their expertise by providing them with personalized KPIs and other live metrics.

- Home Equity: Provides views of production, sales and compliance activity across the home equity side of an organization.

- Loan Loss: Provides key insight into pipeline fallout and potential lost loan business.

- Operations: Provides pipeline and activity overview of each key functional area of the loan origination process.

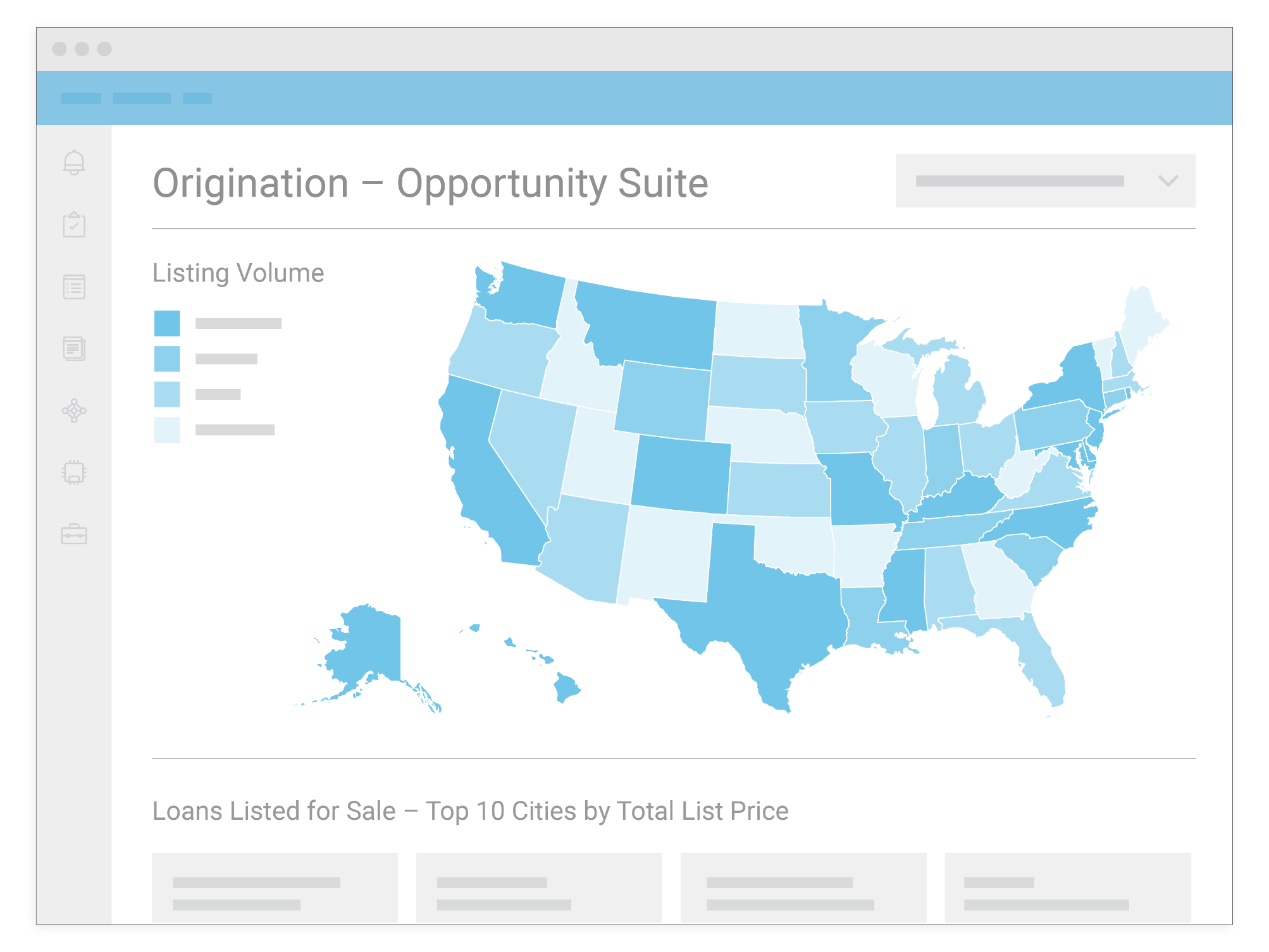

- Opportunity: Combines LOS┬аdata with premium data sets to┬аautomatically surface purchase,┬аrefinance, and home equity origination┬аopportunities.

- Post Closing: An enterprise-wide overview of a companyтАЩs closing activity which then provides detailed information on specific post closers.

- Production: Focuses on executive-level metrics, including sales activity, pipeline performance, and forecasting. Additionally, the suite gives users the ability to score and rank their sales staff and know exactly what type of loans theyтАЩre funding and originating.

- Retail Management: An enterprise-wide overview of a companyтАЩs sales activity.

- Total Processing: An enterprise-wide overview of a companyтАЩs processing activity, as well as detailed loan information on specific processors.

- Underwriting Management: An enterprise-wide overview of a lenderтАЩs underwriting activity, as well as detailed loan information on specific underwriters.

- Wholesale Management: Offers detailed insights into account executive and broker performance, as well as in-depth information into specific metrics within the wholesale process.